Transaction volumes in the country house market remained steady in the third quarter of 2016 (compared to third quarter of 2015).

Last year experienced a slow down due to the pending General Election and this year the market was subjected to the Stamp Duty Land Tax (SDLT) on additional homes and the EU Referendum. The South East showed the highest level of activity with 57 houses sold in Q3 2016.

Guy Robinson, Head of Regional Residential Agency at Strutt & Parker, said: “The regional property market has improved since the EU Referendum and we expect stronger trading conditions to continue throughout the autumn/winter period. Negotiations over Brexit are likely to be protracted and complicated, but it’s ‘business as usual’ in the regional market, with realistically priced property attracting good levels of interest from buyers.”

James Mackenzie, Head of the National Country House department at Strutt & Parker, said: “Activity has improved within the £3m-6m prime country house market with the majority of sales being agreed to British buyers.”

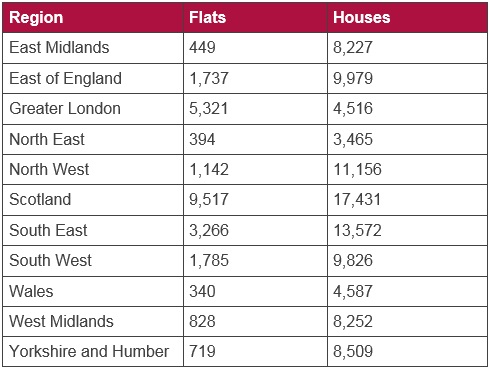

Table 2. Number of Properties Sold by property type for Q3 2016

Source: Dataloft, Land Registry, Registers of Scotland, Strutt & Parker Data for the regional figures includes the latest reported transactions through June 2016

Meanwhile in Prime Central London (PCL), Strutt & Parker data for the third quarter of 2016 showed an uplift of 4.6% in UK domestic market buyers when compared to the same period last year. Following the Brexit vote and the continued uncertainty around this, PCL has retained its attractiveness to overseas buyers with a slight increase of buyers coming from both Western Europe and Asia relative to Q2 2016.

Charlie Willis, Head of London Residential at Strutt & Parker, said: “The fall in sterling against certain currencies following the Brexit vote, particularly the dollar and the swiss franc, has definitely been a major contributing factor to the increase in buyers we have seen from Europe and Asia since June. For overseas buyers, this currency play instantly wipes out the formerly prohibitive cost of 15% Stamp Duty on the most expensive properties."

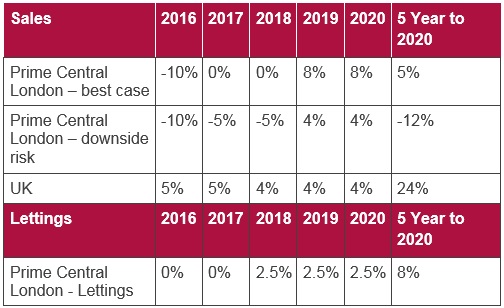

Residential price forecast Q3 2016