With the new Digital Economy Bill coming into play soon, it’ll mean some changes for landowners. Here’s what you need to know…

What is the code?

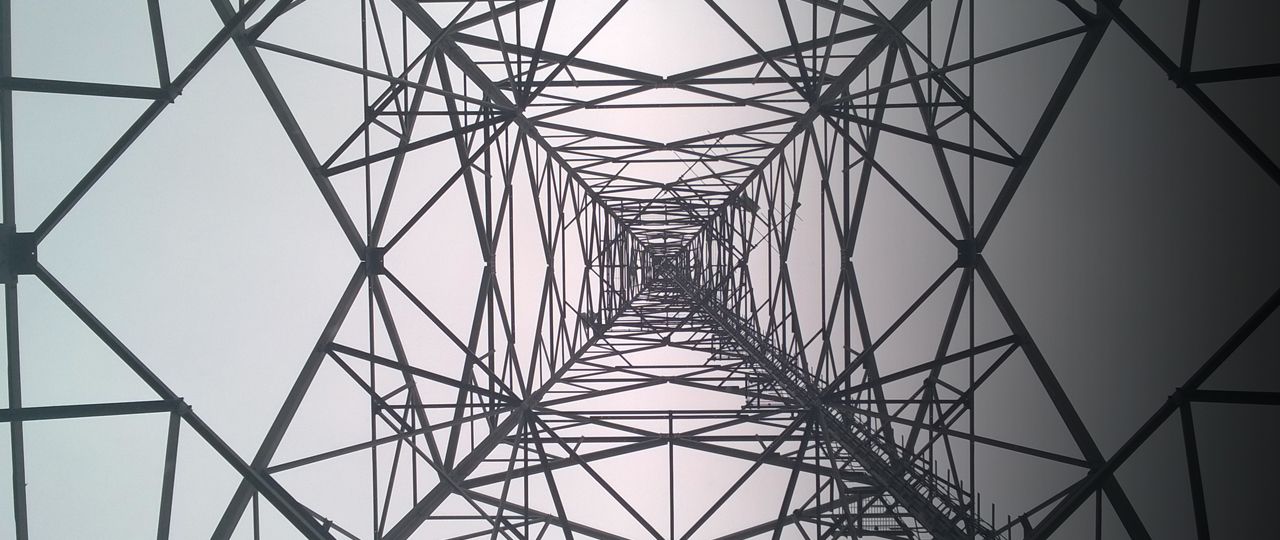

The code as it stands allows the installation and maintenance of electronic communications networks across the UK. It was originally created for landlines, and so was in need of an update to reflect the changing nature of telecommunications.

These days, the network is more used by mobile operators. Under the code, such operators are allowed to build their infrastructure on public land and private land, though they need landowner permission before installing equipment on private land. If permission is not granted, they can bring in the local courts to get the decision overturned.

There are three main parties involved – the landowners, the Mobile Network Operators (MNOs) and intermediaries like Arqiva, an infrastructure provider operating many of the sites in the UK.

When it comes to the price charged for allowing building on land, the current code doesn’t regulate the price for access, unlike with other utilities like water.

What are the proposed changes?

The new code, part of the Digital Economy Bill that is currently going through Parliament, aims to address both the issues of right to build and the price charged by landlords for installing equipment on private land.

It will be closer to the compulsory purchase system used by other utilities. It means a change to how value is assigned to the land. Under the new code, value will be based on what it’s worth to the landowner and not what it’s worth to the MNO. Estimates suggest this would lower the price of land by around 40%.

Minister of State for Culture and the Digital Economy, Ed Vaizey, said: “This will ensure property owners will be fairly compensated for use of their land, but also explicitly acknowledges the economic value created from investment in digital infrastructure.”

It’s been suggested the new code will basically give control of the land over to the operators, allowing them to assign leases, share sites and upgrade and install additional equipment as and when they require. They will be given wider access rights that could cause major inconvenience and potentially operational risk to the landowners.

The site sharing rights are a particular concern to landlords as it’ll mean that either MNOs or intermediaries will be able to charge site share fees and benefit from the profits at the expense of the landowners.

What will the effects be?

If the new code comes into practice, it could affect thousands of landowners, with many predicting that existing leases drafted in terms of the existing code could be overridden by the new measures.

And while the Government is introducing the code to bring more sites into use and increase mobile network coverage, some believe that the code would be tested and disputed, which would hamper the rollout of new sites rather than facilitate it.

‘Not spots’ are already being created in city centres as a result of the proposals as potential site providers withdraw from the market.

Another key Government target with the code is to reduce the cost of mobile provision to the public. But there are worries that intermediaries will not actually pass the rental reductions through to mobile operators.

And it’s not just private landlords that rent out land to MNOs. Charities, churches, schools, and local authorities will all suffer under the new code. Not only that, but as the value of the lands drops, so will the business rates paid by telecoms companies, hitting local businesses as well.

Operator changes

Following concerns about competition, telecoms regulator Ofcom has recently ordered BT to separate itself from its Openreach division, which runs the country’s broadband infrastructure. In November it instructed BT to turn Openreach into a distinct company with its own board. Ofcom believes the legal split will improve competition and investment in the UK’s broadband infrastructure in the long term.

Additionally, the main operators have split into two groups – MBNL (EE and Three) and CTIL (Vodafone and O2) – and earlier this year, BT bought EE, raising complications on some sites where BT held their own licence as a separate site sharer.

Amid the turmoil of network consolidation and joint ventures, the once ‘safe’ leases with Airwave, which currently manages the Emergency Services Network (ESN), also face uncertainty. The government has awarded the new ESN contract to EE, which is acquiring new sites for this network. The phasing out of the Airwave sites will run until 2020, but it is not yet known if they will be used for alternative purposes.