Strutt & Parker data for the third quarter of 2016 showed an uplift of 4.6% in UK domestic market buyers in Prime Central London (PCL) when compared to the same period last year.

However, overall data shows that both the volume of sales and the sum of the selling prices have fallen by 47% between Q3 2015 and Q3 2016 (Lonres.com and Strutt & Parker). A total of 384 properties were sold in PCL during the third quarter of 2016.

Charlie Willis, Head of London Residential at Strutt & Parker, said: “The low volume of transactions is indicative of a market where only properties at realistic prices with motivated sellers are completing. We have seen a noticeable increase in viewing from committed buyers, throughout later September and October, and this has led to an uptick in transaction volumes. Particularly where sellers have been realistic and adjusted asking prices according to market sentiment.”

However, despite the Brexit vote and the continuing uncertainty, PCL still retains its attractiveness to overseas buyers with a slight increase of buyers coming from both Western Europe and Asia relative to Q2 2016.

Charlie Willis continues: “The fall in sterling against certain currencies following the Brexit vote, particularly the dollar and the swiss franc, has definitely been a major contributing factor to the increase in buyers we have seen from Europe and Asia since June. For overseas buyers, this currency play instantly wipes out the formerly prohibitive cost of 15% Stamp Duty on the most expensive properties.”

The current economic conditions, alongside the new Stamp Duty Land Tax for additional homes, are also having a combined impact on the PCL lettings market – which is 36% down compared to Q3 2015. However, Knightsbridge and Belgravia reported that volumes were up 10% compared to Q2 2016.

Kate Eales, National Head of Lettings at Strutt & Parker, said: “Despite volumes of lettings transactions being down year on year in PCL, we have seen tenancy length increase, as well as a surge of demand in ‘super prime’ with transactions up 50% year on year in properties over £8,000 per week.”

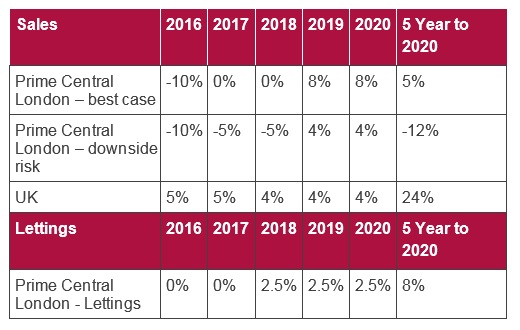

Residential price forecast Q3 2016