The latest publication in our Property Futures research series – Property Futures III: A Flexible Future – looks at the historical impact of lease length remaining on investment returns, alongside an assessment of what we can expect in the future, and what investors can do to mitigate the risk.

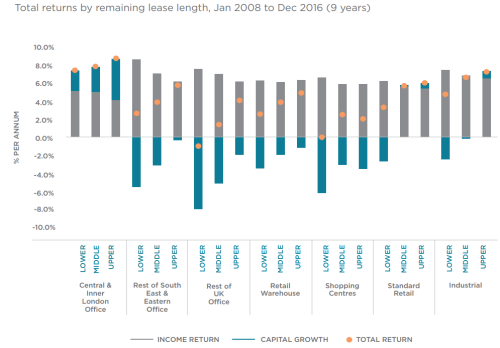

On the surface, the research tells a negative story: properties with (relatively) shorter remaining lease lengths (accounting for break clauses), have underperformed across this most recent real estate cycle (2008-2016) – see chart below.

Source: MSCI

In a ‘perfect’ investment market, this should, of course, not occur. The ‘market’ should demand an upfront yield that accounts for the risks posed by a shorter lease length. Thus data suggests that the ‘market’ has fundamentally mispriced (not accounted correctly) for risk on shorter-let properties; hence the underperformance.

The immediate takeaways for investors would seem to be: keep buying long-let property, avoid leasing risks and associated void costs; take the view that higher yields on shorter-let property do not provide enough compensation for the issues that are likely to evolve over the life of the investment. Play it safe.

However, this is far too simplistic.

When we break down the drivers of total return we can see capital growth is the key outperformance driver, and within it yield impact - this being capital growth attributable to changing capitalisation rates; as opposed to changing passing and market rents. Thus one of the major factors in the outperformance is investors’ own perception of future performance from assets and the crowd-driven yield compression that results.

If we were to stop the analysis here, we would perhaps then take the opposite view!

Namely, that the only reason long-let property has outperformed is because investors believed it would, and have driven a self-fulfilling prophecy by bidding down yields on said property and driving consequential outperformance via yield impact’s effect on capital growth.

We would also form a resulting conclusion, that in the next period short-let property would inevitably outperform; given higher yields to start with and with little room for further yield compression on longer-let property.

Again this is wrong.

Although capital growth (via yield impact) has been the major driver of outperformance, and income returns on shorter-let property look attractive, we need to remember that income returns are calculated on a capital employed basis. E.g. even if an asset saw some floorspace fall vacant, and passing rent decline as a result, if its valuation yield increased at the same time, with capital value falling further still, then relative to its capital value, the income return generated by the reduced passing rent would be held up.

So what is really going on?

The really important issues are the actual upfront cashflow received on the property, the future growth in that cashflow and its reliability - you could say the latter two are essentially the same thing.

What MSCI’s data shows is that properties with relatively shorter time left on the lease see very poor performance in actual rents received e.g. when leases come to an end they are often falling void, with the associated void costs eating away at rent received. This issue is particularly acute in the office sector.

Thus we can conclude, to a degree, that investors have been correct to target longer-let property, given the extent to which void costs have undermined levels of actual rent received.

Looking forward, then, investors are faced with two major, and overlapping issues. Occupier demand for flexibility is likely to continue to rise; exposing the ongoing issue of void costs that are the result of a clunky lettings market. Whilst at the same time, occupiers seeking flexibility are increasingly likely to pay a premium for it, whilst those willing to agree long-term leases will have the whip hand in negotiations and may well be able to achieve discounts.

So, in other words, investors willing to deal with tenants’ desire for flexibility will achieve the highest market value rental growth, but in order to outweigh the negative effects of this flexibility will need to improve the process for getting tenants in and out of properties markedly.

I will cover the improvements in process we are likely to see in a future blog. For those who can’t wait, please read our full research paper Property Futures III: A Flexible Future.