Strutt & Parker maintains UK house price forecast as buyer competition remains strong against ongoing lack of supply

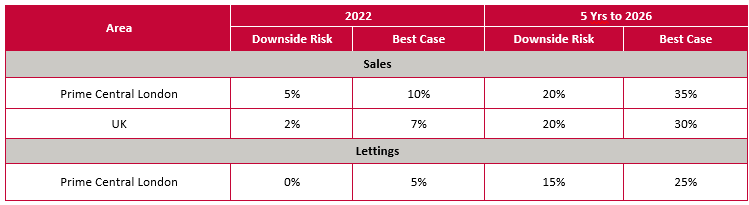

Strutt& Parker has maintained its UK house price forecast for 2022, despite newpressures presented by recent interest rate rises and inflation. The propertyconsultancy’s latest forecast shows UK property prices remain on course to growby up to 7% and up to 10% for Prime Central London (PCL) as demand from buyersremains strong in a housing market with ongoing supply constraints.

Guy Robinson, Head of Residential at Strutt &Parker, said:

“Despitethe current challenges in the market, the sector remains very robust and we areoptimistic for 2022 as we expect to see a very competitive market this year.The impact of the challenges are likely to unfortunately impact aspiring firsttime buyers rather than current home owners. With demand continuing to outstripsupply, the extreme shortage of stock will sustain further house price growth.

“Oneof the main drivers of demand is the continued shift in individuals’requirements of homes and locations. As a result, the regional housing markethas seen strong price growth, driven by large demand and low stock availabilityin the regions. Commuter towns are retaining their popularity but with manyemployers still working to hybrid models, this is opening up more buyingoptions beyond traditional high employment areas.”

Vanessa Hale, Head of Residential Research andInsights at Strutt & Parker:

“Thecurrent economic outlook is optimistic for 2022. The rises in interest andinflation rates are unlikely to have an immediate impact on house prices as wehave not seen a reversal in the behavioural shifts seen as a result of thepandemic. Therefore the shortage of stock and high demand will to have animpact on house price growth and our forecast reflects this.”

For Prime Central London, Strutt & Parker’s sales index datafor Q4 2021 showed record quarter on quarter growth of 0.7% and year-on-yeargrowth to 1.8%.

Louis Harding, Head of London at Strutt &Parker, comments:

“The2022 sales market is showing signs of very strong demand, which will bemaintained with the return of international buyers, however, stock levels aredown year on year, particularly in the house market, which is resulting inelevated prices being achieved. Last year within London, activity cooledslightly as autumn arrived, following a high level of transactions in the primecentral London market in the first half of last year. However, the super-primemarket moved very well in 2021 with many stand out sales seen in some of thecapital’s most exclusive postcodes.

“Lettingsin PCL exceeded expectations but lack of stock is an issue and as a result weexpect moderate growth for 2022.”

Across the UK, current sales stock volume is down 30% year onyear and the average time spent on the market (excluding London) has decreasedby 11% on 2021 and 24% on 2020, highlighting the competiveness of the market.The greatest differential in terms of applicants compared with stock is seen inExeter and Norwich, two areas that have consistency experienced high levels ofinterest in the last two years.

Other competitive markets across the UK include Guildford,Inverness and Newbury, with last year’s applicant numbers up 68% on averagecompared with pre-pandemic levels.

Kate Eales, Head ofRegional Agency at Strutt & Parker comments:

“OutsideLondon, we expect buyers to adapt to this very competitive market. With buyerslooking for value or money and considering the next town along to hot spots andresearching lesser well-known areas that have plenty to offer. It’s not justspace that buyers dream of, a good community will be a strong factor with localpubs, independent shops, transport links and schools continuing to drivepopularity.

“We are also expecting more buyers to consider a move to thecoast. Our latest Housing Futures survey revealed that coastal areas are apopular location for people looking to move in the next five years. The desireto live near the shoreline saw a dramatic increase – from only 4% stating itwas their current area to 18% saying it was a future area they desired to live.When it comes to locations, I think we will see Suffolk and Norfolk coming intotheir own, along with Eastbourne and other quintessential seaside towns.”

The estate agency’s five year forecast estimates price growth inthe UK with a best case of 30% and 20% downside risk. Prime Central London’sforecast remains at best case of 35% growth and 20% downside risk.