Matthew Henderson

Associate Director, Residential Research

Associate Director, Residential Research

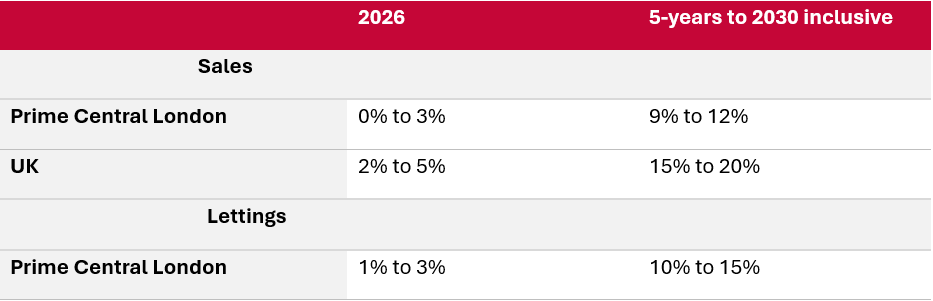

Strutt & Parker has a positive view for the UK housing market with growth of up for 20% over the next 5 years. Transaction levels remained above 300,000 transactions over Q4 – this is the pre-COVID average. The last 12 months have seen a 2.5% growth in house prices however this has been more heavily weighted to more northern, typically more affordable, regions.

Overall, the PCL housing market saw fewer transactions in Q4, against Q3, with the number of homes sold for over £1m down 12%. This is as we would expect with market seasonality, exacerbated by the delayed Autumn Budget.

The very top end of the market has been faring best, with the volume of £5m+ sales 34% higher in Q4 2024 than Q4 2024 and the only price bracket with a greater number of sales against Q3 2025 was £10m+; 23 sales up to 29.

“Now the dust has settled on matters of taxation, including changes to non-domicile status, we’re noticing a returned strength in investment from US, Middle Eastern and Asian buyers as the UK continues to be regarded as a secure environment.” says Claire Reynolds, Strutt & Parker’s new National Head of Sales.

Strutt & Parker has seen applicants with £8m+ to spend in PCL increase by over six times in the first two weeks of January, compared to 2025. There are numerous good value opportunities for purchases in this market for those buyers who consider themselves shrewd.

“Buyers are showing interest earlier in the year than is typical, generating confidence throughout the market and, while pricing remains sensitive, there are many who want to capitalise on good value opportunities in prime locations.” continues Claire.

Rents in PCL have fallen very marginally over this quarter, by -0.1%, despite the speculation that landlords are leaving the market – due to the Renters’ Rights Act – which would drive up values. However, over the course of 2025 rents grew 1.1%. This could be attributed to a challenging sales market that has stopped some landlords from selling up and even brought some sellers into the rental market.

The number of new lets under £1,000pw was 61% in Q4. This is a marked shift from 79% of the market in this rental bracket formed in 2021. Driven by long term undersupply this has swelled the prime parts of the market, with the number of new lets over £2,000pw now at 11%, up from 6% in 2021.

Seasonality continues to dictate the PCL new lets market, with a strong Q3 dropping away, by 41% to Q4. Yet Q4 2025 was multiple times stronger than an extremely low Q4 2024. We expect the number of new lets to grow over the first half of this year, again peaking in the third-quarter.

Matt Henderson, Residential Research Lead adds ““Buyers in prime residential markets had their decision-making ability stifled last year as a result of global uncertainty alongside relentless speculation over property taxation which led to a more stagnant market in 2025.

The introduction of a High Value Council Tax Surcharge was less punitive than many expected. Starting at around £200 per month this charge is unlikely to have a large impact on high-end super-prime markets where such additional costs can be absorbed into wider household outgoings.

This, paired with the December cut to the base rate, has had a reinvigorating effect on the prime markets. Mixed with what is a strong underlying market – having reached 1.2 million for the first time since 2021 – we have a positive outlook for 2026. The likely further cuts to base rate will continue to improve affordability helping to further boost housing transactions, particularly in the more costly southerly regions.”