Vanessa Hale

Director, Research

Director, Research

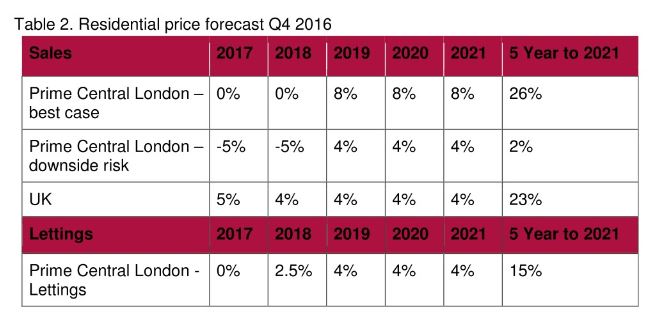

Strutt & Parker and its economic forecasters Volterra are predicting steady UK house price growth of 5% in 2017. In contrast, its forecast for the Prime Central London (PCL) is static at 0% as a best case scenario, with downside risk of -5% growth over the next year.

Vanessa Hale, Partner in Research at Strutt & Parker, comments: “Uncertainty will continue with the upcoming global events in 2017 generating volatility and making it a challenge to forecast. However, with creeping inflation and questions of how long the Bank of England can hold interest rates, the extraordinary shortage of housing stock in the UK alongside housing demand will continue to keep house prices stable in London with a slight uptick across the UK.”

According to the Nationwide House Price Index, UK property prices grew 4.5% during 2016 overall. Historically London has been the driving force of UK prices, but this changed during 2016. Whilst London achieved growth of 3.6% over the year, the region was outperformed by 8 of the 12 other regions, most notably East Anglia (10.1%), Outer South East and Outer Metropolitan (6.9% and 6.8% respectively). Price growth in London dipped below the UK average in 2016 for the first time in eight years, according to Nationwide.

Guy Robinson, Head of Regional Residential Agency at Strutt & Parker said: “Whilst Brexit headwinds still exist the country is getting back to business as usual. The lack of housing supply and strong demand will continue to drive pricing up, though perhaps in single digits.”

Transaction volumes in the high end £2m+ property market remained relatively steady in 2016 compared to 2015, with the South East showing the highest level of activity with over 600 houses sold in 2016.

In Prime Central London it was a different story with transaction levels in 2016 nearly 25% down compared to 2015. It should be noted that there was a slight pick-up in transactions during the final two quarters of 2016, but levels remain considerably below the five year average.

Charlie Willis, Head of London Residential Agency, said: “The politically driven changes of Stamp Duty Land Tax (SDLT), Annual Tax on Enveloped Dwellings (ATED), non-dom status and SDLT on additional homes through 2015 and 2016 have laboured the downward trend stalling transactions and new investment in Prime Central London.”

With more incidences of sellers prepared to review pricing and entertain reasonable offers in PCL, it appears the market has found a level which may provide a spur to transaction levels. Strutt & Parker data for the fourth quarter of 2016 showed a small uplift of 4.6% in UK domestic market buyers in PCL when compared to the same period last year. Looking at financing options and Strutt & Parker buyer profiles, there has been an increase in cash purchases with nearly 55% in 2016 compared to 46% in 2015. There has also been a shift with more people desiring to purchase a house (52%) over a flat (48%) in 2016 compared to 40% and 60% respectively in 2015.

The current economic conditions and the SDLT for additional homes which went into effect in April 2016 are also having an impact on the lettings market in PCL. There were nearly 11,000 property lets agreed in PCL in 2016, which was 31% down compared to 2015 when nearly 16,000 property lets were agreed.

Kate Eales, National Head of Lettings at Strutt & Parker, explains: “The lack of new tenancies in PCL year on year reflects the uncertainty in the market following Brexit, our tenant profiles show that over 40% of our tenants are European and those tenants are simply renewing and staying put to see how Article 50 unfolds.”